Goods and service tax is an indirect tax that is applicable across the country on products and services. The purpose behind the establishment of GST is to combine various indirect taxes that are applied at different levels. It is ruled by GST council and its chairman is finance minister of India. Read More…

GST is launched on 1st of July and is set to change the way people pay their taxes. It is expected that new tax regime will help in improving the collection of taxes and boost the development of Indian economy too. In fact, this removes the indirect tax barriers between the states as well as integrates the country through an identical tax rate.

After the implementation of this tax regime, there will be a single tax on goods and services. This is the biggest change in the Constitution since India got independence.

This replaces different indirect taxes like service tax, entry tax, luxury tax, central excise tax, purchase tax, value added tax, central sales tax, and advertisement tax etc. Goods and service tax council has presumed a method of implementing this new tax system. It is divided into three categories including CGST, SGST, and IGST.

- The CGST is applicable where the central government is going to collect the revenue.

- Whereas, SGST is applicable where the state government collect revenue for interstate sales.

- IGST or integrate GST is applicable in the case where the central government collects the interstate sales revenue.

Goods and service tax council relax filling norms due to unclear vision on GST. There is an announcement of relaxation of 2 months by the taxpayers to fill up GST returns. This means they will not charge any late fee till the September 2017. GST app Also has launched. Read more…

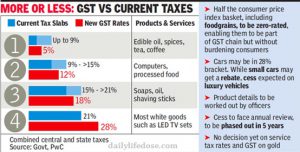

Items that become Costlier and those which become Cheaper

The Council decides to continue tax concession on 83 services that include education, health and travel services. Government has kept Different items under different tax slabs i.e. 0%, 5%, 12%, 18% and 28%. They finalise the tax rate for 1,211 items in which majority of items come under the 18 percent slab. Some items become cheaper and some become more costly. The items like a cigarette, commercial vehicle, branded jewellery, mobile phone calls and textile become costlier. On the other hand, cement price, movie ticket, auto price, fans, water and air cooler become cheaper.

The items like a cigarette, commercial vehicle, branded jewellery, mobile phone calls and textile become costlier. On the other hand, cement price, movie ticket, auto price, fans, water and air cooler become cheaper.

Many software companies are focusing on developing new applications that include all the new tax slabs. Their purpose is just to do this easy for the businessman to understand under which category they fall in. In this article, you can get full information about items that are on which tax slab. Read other schemes launch by Finance Minister of India.

0% slab covering Goods and Services

The eatable items like milk, buttermilk, fresh meat, curd, honey, flour, vegetables, besan and fish chicken etc do not have any tax. Other items under this tax slab are newspapers, handloom, bangles, bindi, sindoor, Kajal, drawing books, judicial papers, printed books and more. The lodges and hotels having crowd below Rs. 1000 are exempted under GST.

5% slab covering Goods and Services

GST Council decides that 13 services such as travelling by road, the air in economy class will attract 5% tax. This category covers the goods including cream, packaged food, coffee, frozen vegetables, spices, coal, tea, kites, Apparel less than Rs. 1000, footwear below Rs. 500, skimmed milk powder, stamp postmark, kerosene, medicines, Raisin, insulin, ice, biogas and cashew nut etc.

The services under this tax slab are small restaurants and transport services which include air and railways are also under this category. Main input of transport services is petroleum which is outside of GST.

12% slab covering Goods and Services

The goods including coloring books, sewing machine, Apparel above Rs 1000, butter, ghee, Ayurvedic medicines, chess board, animal fat, playing cards, tooth powder, ketchup, cell phones, fish knives, exercise books, agarbatti, corrective, all diagnostic kits and spectacles etc.

The services like business class air ticket, state-run lotteries, fertilizers, none- AC hotels and work contracts come under 12% GST tax slab.

18% slab covering Goods and Services

According to the GST Council, 81 percent of items fall below the 18% GST rate slabs. The majority of items are under this slab includes mineral water, notebooks, ice cream, steel products, instant food mixer, pastries, cake, pasta, sugar, footwear above than Rs 500, tissues, Kajal pencil stick, CCTV, printers, electrical transformers, aluminium foil, soups, and jams etc.

18% tax slab attract the services like telecom services, IT services, branded garments, AC hotels, restaurants inside five-star hotels and room traffic from Rs. 2500 to Rs. 7500.

28% slab covering Goods and Services

ATM, automobiles, wallpapers, hair shampoo, water heater, pan masala, deodorants, motorcycles, ceramic tiles, vending machine, shavers, chocolate not containing cocoa, sunscreen, shaving cream, aerated water and vacuum cleaner attract this highest tax slab under GST.

The services including hotels with room traffic more than Rs. 7500, private run lotteries that are authorized by the states, 5-star hotels, cinema, and race club betting are fallen under this category.

Effects of GST in Indian Economy

This tax regime can result in increasing employment, promotion of exports and consequently boost the overall economic growth as well as factors of production like land labour and capital. It is a prediction after the implementation of GST, India will get revenue of 15 billion dollars per annum. This also increases the flow of foreign direct investments. Due to changes in products tax slab, the prices of goods and services will also fluctuate. This will directly imply impact on the global share market and help you to promote your business too.

Wrapping Up

The main purpose of implementing this new tax rule is to consolidate the indirect tax to subsume multiple existing indirect taxes. This will benefit the Indian economy in a number of ways. Its impact on the price of goods and services will depend on the items.